In this post, I will provide an in-depth breakdown of the implied forward rates and breakeven rates across various time horizons, offering valuable insights for those interested in the intricacies of Treasury markets.

If you want to better understand forward rates and how they are calculated, please see this blog post I wrote about it.

Additionally, moving forward I will be using the Treasury rate information directly from Treasury.gov. In prior forward rate posts, I've used Refinitiv data from Microsoft Excel, but I noticed that the rates were not matching up to what the US Treasury is putting out. I do not believe that the Refinitiv data is inaccurate, the US Treasury data is just more accurate.

Understanding Key Concepts

Forward Rates: These are interest rates implied by the current yield curve for periods of time in the future. Essentially, they represent what the market expects interest rates to be in the future.

Breakeven Rates: These are the rates at which the cost of holding a security “breaks even” with the expected future rate. They provide insight into the market's inflation expectations and interest rate predictions.

Breakdown of Implied Forward Rates

Treasury Rates

| Term | 6/28/2024 | Last Week | Last Month | Last Year |

|---|---|---|---|---|

| 1M Treasury | 5.48% | 5.47% | 5.48% | 5.32% |

| 2M Treasury | 5.53% | 5.47% | 5.48% | 5.47% |

| 3M Treasury | 5.46% | 5.48% | 5.51% | 5.46% |

| 4M Treasury | 5.46% | 5.45% | 5.46% | 5.52% |

| 6M Treasury | 5.34% | 5.33% | 5.37% | 5.54% |

| 1Y Treasury | 4.98% | 5.09% | 5.08% | 5.44% |

| 2Y Treasury | 4.60% | 4.71% | 4.72% | 4.99% |

| 3Y Treasury | 4.39% | 4.52% | 4.50% | 4.68% |

| 5Y Treasury | 4.22% | 4.33% | 4.31% | 4.37% |

| 7Y Treasury | 4.23% | 4.33% | 4.29% | 4.22% |

| 10Y Treasury | 4.28% | 4.36% | 4.29% | 4.05% |

| 20Y Treasury | 4.57% | 4.61% | 4.52% | 4.23% |

Data from US Treasury website

Breakeven Rates

| Spot Term | 1m Fwd | 2m Fwd | 3m Fwd | 4m Fwd | 6m Fwd | 1y Fwd | 2y Fwd |

|---|---|---|---|---|---|---|---|

| 1m | 5.58% | 5.35% | 5.53% | 5.31% | 5.27% | 5.18% | 5.21% |

| 2m | 5.45% | 5.40% | 5.35% | 5.17% | 5.04% | 4.84% | 4.67% |

| 3m | 5.45% | 5.32% | 5.24% | 5.09% | 4.92% | 4.71% | 4.48% |

| 4m | 5.38% | 5.25% | 5.16% | 5.02% | 4.83% | 4.63% | 4.37% |

| 6m | 5.25% | 5.12% | 5.02% | 4.88% | 4.58% | 4.51% | 4.25% |

| 1y | 4.95% | 4.87% | 4.79% | 4.71% | 4.59% | 4.22% | 3.97% |

| 2y | 4.59% | 4.53% | 4.48% | 4.42% | 4.34% | 4.10% | 4.01% |

| 3y | 4.39% | 4.35% | 4.32% | 4.28% | 4.23% | 4.08% | 3.97% |

| 5y | 4.24% | 4.21% | 4.20% | 4.18% | 4.15% | 4.07% | 4.08% |

| 7y | 4.25% | 4.24% | 4.23% | 4.22% | 4.20% | 4.14% | 4.17% |

| 10y | 4.31% | 4.30% | 4.30% | 4.29% | 4.28% | 4.24% | 4.29% |

Breakeven Change in Rate

| Spot Term | 1m Fwd | 2m Fwd | 3m Fwd | 4m Fwd | 6m Fwd | 1y Fwd | 2y Fwd |

|---|---|---|---|---|---|---|---|

| 1m | 10.00 | -13.46 | 5.40 | -17.25 | -20.93 | -30.09 | -27.40 |

| 2m | -8.00 | -12.73 | -18.30 | -35.62 | -49.46 | -68.80 | -86.33 |

| 3m | -0.67 | -13.82 | -21.53 | -37.08 | -54.31 | -75.14 | -98.47 |

| 4m | -8.00 | -20.86 | -29.65 | -44.31 | -63.23 | -83.40 | -108.91 |

| 6m | -9.33 | -21.91 | -31.76 | -45.54 | -76.32 | -82.82 | -109.11 |

| 1y | -2.56 | -11.48 | -18.53 | -27.10 | -39.25 | -75.93 | -100.94 |

| 2y | -1.16 | -7.22 | -12.22 | -17.86 | -26.29 | -50.44 | -58.96 |

| 3y | 0.21 | -3.86 | -7.17 | -10.85 | -16.13 | -30.95 | -42.29 |

| 5y | 1.63 | -0.58 | -2.32 | -4.25 | -6.79 | -14.57 | -13.78 |

| 7y | 2.37 | 0.92 | -0.19 | -1.44 | -2.99 | -8.79 | -6.28 |

| 10y | 3.07 | 2.24 | 1.65 | 0.97 | 0.29 | -3.80 | 0.56 |

| AVG | -1.13 | -9.34 | -12.24 | -21.85 | -32.31 | -47.70 | -59.26 |

Analysis and Market Expectations

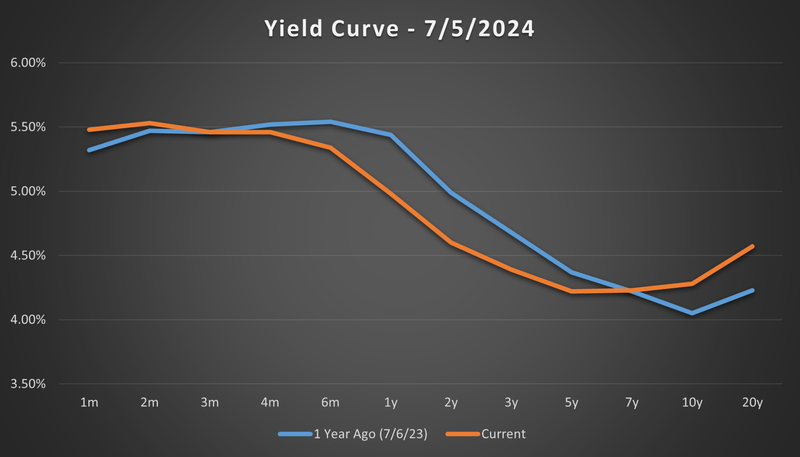

In recent weeks, market sentiment has remained relatively stable, despite some fluctuations in key economic indicators. Let's delve into the factors influencing current market trends and what they might mean for future rate changes.

There does not seem to be much change in market sentiment from last week. However, it is interesting to note that the implied 1-month rate, 1 month forward, is 10 basis points higher. This is likely due to the overall implied smoothing. Essentially, the market believes that the curve will smooth gradually, not as quickly as some believed a year ago.

Additionally, we saw unemployment rise. While the economy did add 206,000 jobs in June, unemployment ticked up from 4.0% to 4.1%. This is mixed news at best for rate cuts in 2024. We will need to see inflation come down further and unemployment tick up higher before we can start to talk about a cut in the Fed Funds rate.

Short-Term Expectations

- The 1-month forward rates show a mix of positive and negative changes, suggesting some short-term uncertainty or volatility.

- The 1-month spot rate is expected to drop by 1.13 basis points on average across all maturities.

Medium-Term Expectations

- The 6-month forward rates exhibit larger drops, particularly in the shorter maturities (e.g., the 3-month and 4-month rates drop by -31.76 bps and -45.54 bps, respectively).

- The average drop in the 6-month forward rates is -32.31 bps, indicating a more pronounced expectation of rate decreases in the medium term.

Long-Term Expectations

- Forward rates for 1-year and 2-year terms also show significant declines. For instance, the 1-year forward rate is expected to drop by -75.93 bps one year from now.

- The average drop in 1-year and 2-year forward rates are -47.70 bps and -59.26 bps, respectively.

Strategic Insight

Predicting market movements is always risky. However, in my opinion, the implied market sentiment is justified. Here is how these implied rates impact investors:

Bond Investors

- Price Appreciation: Investors holding existing bonds might see an increase in bond prices as yields are expected to fall, resulting in potential capital gains.

- Yield Lock-in: Investors might consider shifting to longer maturities to lock in higher yields before further declines occur.

Equity Investors

- Cost of Capital: Lower interest rates can reduce the cost of capital for companies, potentially leading to higher profitability and stock price appreciation.

- Dividend Yields: With falling bond yields, dividend-paying stocks might become more attractive, potentially driving up stock prices in stable, high-dividend sectors.

Alternative Investors

- Real Estate: Lower interest rates generally lead to lower mortgage rates, boosting the real estate market and increasing property values and rental yields.

- Commodities: Lower interest rates can weaken the currency, often boosting commodity prices, benefiting investors in gold and other commodities.

Conclusion

The forward rate changes imply a broad expectation of declining interest rates across various maturities, with the most significant declines expected in the medium term. This indicates market sentiment leaning towards economic easing and potential rate cuts, driven possibly by inflation control measures and other economic conditions.

For more detailed analysis and ongoing updates, make sure to check back regularly on my blog. If you have any questions or need further clarification on any points, feel free to leave a comment or reach out directly.

Works Cited

"Interest Rate Statistics." U.S. Department of the Treasury, https://home.treasury.gov/policy-issues/financing-the-government/interest-rate-statistics. Accessed 6 July 2024.

"Jobs Report Today: Economy Added 206,000 Jobs in June, Unemployment at 4.1%." MSN Money, https://www.msn.com/en-us/money/markets/jobs-report-today-economy-added-206000-jobs-in-june-unemployment-at-41/ar-BB1pteVX?ocid=BingNewsSerp. Accessed 6 July 2024.

Disclaimer: The information provided in this blog post is for educational and informational purposes only. It should not be construed as financial advice or a substitute for professional financial guidance. Everyone's financial situation is unique, and readers are encouraged to consult with a qualified financial advisor or planner before making any financial decisions.

Additionally, AI technology was utilized to edit and optimize this post for clarity and readability.

Add comment

Comments